ISLAMABAD: Sui Southern Gas Company Limited (SSGCL) is unlikely to give dividend to its shareholders due to weak financial position owning to disputes with KE and PSM.

The gas utility company has informed PSX that as disclosed in unconsolidated financial statements, trade debts include receivables of Rs. 26,289 million and Rs. 22,272 million from K-Electric Limited (KE) and Pakistan steel Mills corporation (Private) Limited (PSML), respectively. significant portion of such receivables include overdue amounts, which have been considered good by management and classified as current assets in the unconsolidated financial statements.

Further, KE and PSML have disputed Late Payment Surcharge (LPS) on their respective balances due to which management has decided to recognize LPS on receipt basis from the aforesaid entities effective from July 01, 2012. Due to the adverse operational and financial conditions of PSML, disputes by KE and PSML with the Company on LPS, and large accumulation of their respective overdue amounts, we were unable to determine the extent to which the total amounts Cue from KE and PSML were likely to be recovered including the timeframe over which such recovery will be made;

The unapproved financial statements say that interest accrued includes interest receivable of Rs. 12,093 million and Rs. 5,858 million from Sui Northern Gas Pipeline Limited (SNGPL) and water and Power Development Authority (WAPDA), respectively. These have been accounted for in line with company’s policy of charging LPS on overdue amounts, but have not been acknowledged by the counter-party.

Due to disputes of the company with WAPDA and SNGPL, and large accumulation of their respective overdue amounts of interest, we were unable to determine the extent to which the interest accrued amounts due from SNGPL and WAPDA are likely to be recovered including the timeframe over which such recovery will be made.

According to the statement, in view of the financial position of the Company, the Government of Pakistan (Finance Division) has confirmed to extend necessary financial support to the Company for the foreseeable future to maintain its going concern status. Hence, the sustainability of the futur€ operations of the Company is dependent on the said support.

The Company has not recognized the accrued markup up to June 30,2023 amounting to Rs. 176,291 million relating to Government Controlled E&P Companies based on Government advise and a legal opinion.

The Company is subject to various material litigations and claims pending adjudication in different courts. The outcome of these cases is uncertain and beyond management’s control.

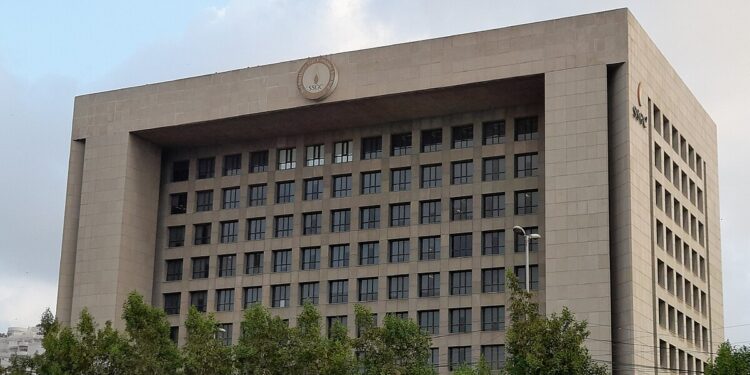

The Annual General Meeting of the company will be held on Friday, 29 November 2024 in Karachi to discuss financial matters and accounts of the company.