ISLAMABAD: Pakistan listed pharmaceuticals sector’s earnings were up by 30% YoY to Rs10.4bn in 1QFY26. This jump in profitability is primarily attributed to higher net sales, improved gross margins, and a decline in finance cost.

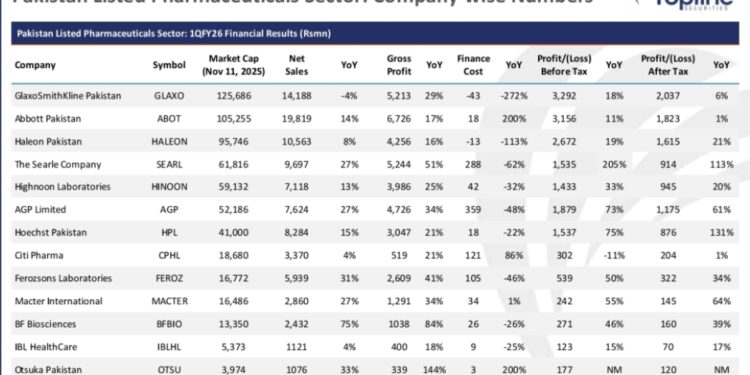

According to Topline Securities net sales increased by 14% YoY to Rs94.0bn in 1QFY26, mainly led by an increase in drug prices following the deregulation of non-essential drugs in Feb-2024. ABOT, SEARL, AGP, FEROZ, and HPL led the sector, showing strong sales growth in absolute terms.

This price increase led to an improvement in gross margins, rising to 42% in 1QFY26 from 37% in 1QFY25 and 41% in 4QFY25. Additionally, the decline in raw material prices and the stable currency further contributed to the increase in gross margins. AGP recorded highest gross margins of 62% in 1QFY26.

Sector’s finance cost also declined by 52% YoY to Rs1.0bn in 1QFY26 amid a drop in the average KIBOR (benchmark lending rate) from 18.5% in 1QFY25 to 11.0% in 1QFY26, along with lower borrowings.

On a sequential basis, earnings increased by 35% QoQ, mainly due to a improvement in gross level coupled with one-off adjustment in SEARL. To highlight, Ex-SEARL pharma growth remained at 8% QoQ. According to Topline Securities, it believes that the Pharma profitability will continue to remain strong as companies are now in phase of launching more new products. Furthermore, the decline in API prices following the drop in crude oil prices will also support the gross margins of the sector.

We prefer high-quality stocks with a higher non-essential product mix, low leverage, strong gross margins, and attractive valuations.

In our strategy report released on Nov 08, 2025, we have mentioned 2 pharma as alpha stocks namely GlaxoSmithKline Pakistan Limited (GLAXO) and Highnoon Laboratories Limited (HINOON).