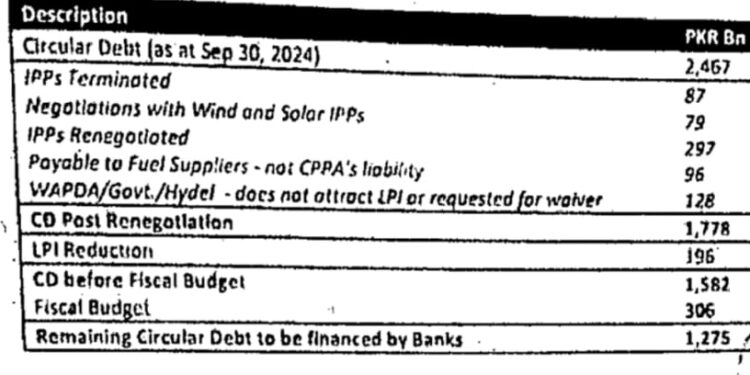

ISLAMABAD : The disbursement of a Rs 1.275 trillion loan aimed at eliminating circular debt in Pakistan’s power sector has hit a roadblock, as the government refuses to proceed until Chinese-funded CPEC (China-Pakistan Economic Corridor) projects offer a discount on their outstanding payments.

Well-placed official sources close to the matter told Newzshewz that significant subjectivity remains around how much each bank should contribute and how the funds should be allocated to Independent Power Producers (IPPs). A major portion of the loan is earmarked for payments to CPEC-related energy projects.

“The Federal Cabinet has decided that the funds cannot be disbursed unless the CPEC projects agree to a discount. This is a firm stance as of today,” the source said.

According to insiders, the government is considering two options i.e. renegotiating payments to CPEC projects on new terms or proceeding with current payment lines, but only if CPEC stakeholders agree to a discount. Otherwise, a new proposal may be required to pay the full overdue amounts without any deductions.

“Until it’s decided how much money the Power Division will draw from each bank and how much will go to each IPP, the whole plan remains in limbo,” the source added.

The IPPs or transmission line established under CPEC are owned by Chinese companies which are also not be being paid their amounts due to financial crunch. Currently, their outstanding receivables have touched Rs 475 billion.

The sources said, since the Prime Minister, Shehbaz Sharif is likely to visit China in August or September 2025 for which preparations are underway, the authorities want to make payments to Chinese IPPs.

The names of banks, which have entered into the agreement with the CPPA-G as Agent of power Distribution Companies are as follows: (i)Meezan Bank Limited ;(ii) Habib Bank Limited ;(iii) National Bank of Pakistan;(iv) Allied Bank Limited;(v) United Bank Limited ;(vi) Faysal Bank Limited ;(vii) Bank Al Habib Limited;(viii) MCB Bank Limited ;(ix) Bank Alfalah Limited;(x) Dubai Islamic Bank Limited;(xi) The Bank of Punjab ;(xii) Bank Islami Pakistan Limited;(xiii) Askari Bank Limited ;(xiv) Habib Metropolitan Bank Limited ;(xv) Al Baraka Bank Limited ;(xvi) Bank of Khyber ;(xvii) MCB Islamic and ;(xviii) Soneri Bank Limited.

According to official document seen by Newzshewz, the federal cabinet approved the following proposals of Power Division with minor amendments in a couple of proposed clauses: (i) CPPA-G has been directed (as agent on behalf of DISCOs) to perform public service obligations and undertake related activities in relation to circular debt stock financing and settlement in terms of Section 7(4) read with Schedule II of the SOE Act as per the proposed terms reflected in the indicative term sheet to be executed by CPPA-G for and on behalf of DISCOs and execute ‘CD Restructuring, Settlement and Subscription Agreement (CDRSSA)’ between the Government of Pakistan, DISCOs and CPPA-G;(ii) Authorized the Power Division)to execute relevant documents as may be required on behalf of the Government of Pakistan per the terms and conditions reflected in the indicative term sheet and to execute the Agreement;(iii) authorized the Power Division) to direct DISCOs to execute relevant instruments and create such security as may be required for the purposes of the financing reflected in the indicative term sheet;(iv) approve the draft amendment in Section 31(8) of the Regulation of Generation, Transmission and Distribution of Electric Power Act, 1997 and the draft legislation be made part of the Finance Bill 2025-26;(v) approved immediate release to CPPA-G and utilization of Rs. 267 billion, already budgeted and available in Power Division demand no 33 under the head of GoP investment in DISCOs equity. Rs. 267 billion would be reduced to the extent of the K-Electric TDS utilization; (vi) approve technical supplementary grant of Rs. 393 billion from Finance Division demand no. 45 to Power Division demand no. 33 to be immediately released to CPPA-G under the head of GoP investment in DISCOs equity; (vii) authorized CPPA-G to utilize amounts to pay off the negotiated payables of Government-owned Power Plants (GPPs). Excess amount, if any, after payment of GPPs shall be utilized for payment to Uch-I & Uch-II for onward payment to OGDCL; (viii) authorized CPPA-G to utilize part of the proceeds raised under the term sheet to settle and retire the outstanding debt obligations of Rs. 683.253 billion of PHL; (ix) authorized CPPA-G to disburse payments to the respective IPPs from the bank financing subject to waive Late Payment Interest (LPI) by the IPPs; (x) approve the draft amendments in Section 3(3) of the Sales Tax Act, 1990 and Section 113(3)(a) of the Income Tax Ordinance, 2001 and the draft legislation be made part of the Finance Bill 2025-26; (xi) the Term Sheet being negotiated is substantially lower than the banking sector benchmark/interbank profit rates, and to approve the exemption from the bidding under PPRA Rules; and (xii) approve the amendment in Rule-5 of the “Pakistan Energy Sukuk Rules, 2019” as follows “5-Redemption. – The Sukuk shall be redeemable before maturity”. Ends