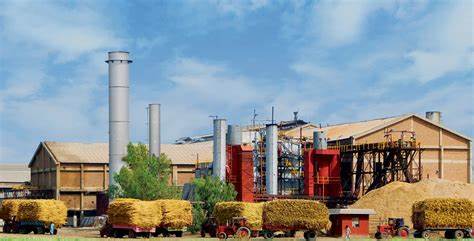

ISLAMABAD: Pakistan’s sugar mills have been accused of price manipulation in collusion with sugar dealers and investors who have hoarded their stocks. These allegations were raised at a recent meeting of the Economic Coordination Committee (ECC) of the Cabinet, which authorized the Ministry of Industries and Production (MoI&P) to take action against any sugar mills if sugar prices spike in the wholesale market.

On August 22, 2024, the Industries and Production Division informed the ECC that the Sugar Advisory Board (SAB) had met on August 21, 2024, chaired by the Federal Minister for Industries and Production. The Board reviewed data from the provinces and the Federal Board of Revenue (FBR) regarding sugar stocks for the 2023-24 crushing year.

All stakeholders agreed that the existing sugar stock was 2.773 million MT as of August 15, 2024, while total consumption over the last 8.5 months was 4.797 million MT. It was projected that consumption over the next 3.5 months would follow a similar pattern, totaling approximately 1.974 million MT. After accounting for 0.150 million MT of anticipated exports—0.055 million MT and 0.040 million MT for Tajikistan—the expected surplus to carry over to the next year would be 0.704 million MT.

After extensive discussions, it was agreed that even with an additional 0.100 million MT of exports permitted, the opening inventory for the 2024-25 cropping season would be 0.604 million MT, exceeding one month’s national consumption.

The Sugar Advisory Board recommended this additional export under the same terms set by the ECC on June 13, 2024, with modifications: (i) extend the export period from 45 to 60 days; (ii) require advance payment through banking channels for exports to Afghanistan, while allowing payment within 60 days for other destinations; (iii) delink the retail price benchmark from export permissions; and (iv) apply the condition of revoking export quotas for non-compliant mills only, rather than the entire Pakistan Sugar Mills Association (PSMA).

During discussions, the Industries and Production Division explained that 0.150 million MT of sugar was approved for export on June 13, 2024. The forum noted that the benchmark for sugar exports should be the wholesale price to ensure better monitoring. It also suggested deregulating the sugar sector, formulating a sugar policy, and zoning for sugarcane cultivation to meet national requirements.

The Ministry of Planning, Development & Special Initiatives noted that the Pakistan Bureau of Statistics (PBS) dashboard provides daily wholesale and retail prices, aiding effective price monitoring. The forum was informed that ex-mill prices do not accurately reflect market trends, as some mills allegedly engaged in price manipulation had investors hoarding stocks in separate warehouses. The Industries and Production Division was directed to monitor sugar stocks and prices daily and to take immediate action against any violators if price spikes were observed.

Following thorough deliberation on MoI&P’s proposal, the ECC decided to extend the export period from 45 days to 60 days and require advance payment through banking channels for exports to Afghanistan, while allowing a 60-day payment window for other destinations. The ECC also agreed to use wholesale prices as the benchmark for export permissions instead of retail prices. The condition for revoking export quotas for non-payment of dues would apply only to non-compliant ex-mills, with the Industries and Production Division responsible for monitoring and reporting to the ECC regularly.

Furthermore, the ECC directed the Cabinet Committee on Monitoring Sugar Exports, established by the Federal Cabinet on June 25, 2024, to ensure ongoing monitoring and review of sugar stocks and prices under revised Terms of Reference (ToRs), to be ratified after the decision. In case of price spikes, the Industries and Production Division is to take immediate action against violators by revoking their export permissions.