ISLAMABAD : The Pakistan Textile Council (PTC) has proposed that the government engage a team of industry experts before initiating talks on a Preferential Trade Agreement (PTA) with the United States.

Commenting on the recently signed pact between Pakistan and the US, the PTC noted that while there is some clarity regarding tariffs, considerable uncertainty remains for the months ahead.

To understand the context, it’s important to recap recent developments. On April 2, 2025, the US imposed a 29% reciprocal tariff on Pakistan—similar to what it imposed on other countries—on top of the existing Most Favoured Nation (MFN) tariffs. A week later, Washington announced a 90-day pause, applying a baseline tariff of 10% (MFN + 10%) until July 9, which was later extended to August 1.

Following “comprehensive negotiations,” a 19% tariff was agreed upon for Pakistan, which some quarters have hailed as a success. While it’s true that Pakistan’s position is not worse than that of its competitors, the imposed tariff remains significantly high. Industry stakeholders had expected a lower reciprocal tariff, in the range of 10–15%, especially after high-level visits by the Deputy Prime Minister and the Finance Minister to Washington.

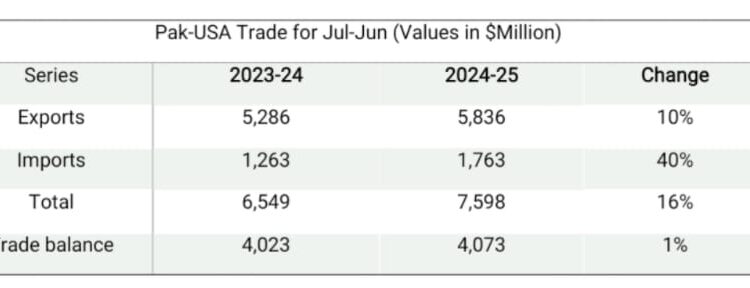

Pakistan reportedly offered to reduce its \$2.9 billion trade deficit with the US by importing American cotton worth \$1 billion, oil-related products worth $1.2 billion, and other goods like soybeans. The government also proposed removing non-tariff barriers identified in the US Trade Representative’s report. Despite these offers, the outcome of the negotiations has been “neutral,” if not disappointing.

According to the PTC, Pakistan’s main competitors in the US market—Vietnam, Cambodia, Sri Lanka, and Bangladesh—are now subject to duties ranging from 19–20% (MFN+). Only India faces a higher 25% reciprocal tariff. However, given India’s competitive cost structure, fiscal support, and export incentives, the 6% tariff difference is likely to be absorbed by Indian exporters. Consequently, Pakistan is unlikely to gain or lose significant m market share in the apparel segment. That said, some US-based buyers of home textiles might consider shifting sourcing to Pakistan if India’s tariffs remain unchanged.

Another critical factor is the rules of origin. Former President Trump’s executive orders specified that transshipped goods would attract higher duties. The orders further stated:

“Certain foreign trading partners identified in Annex I to this order have agreed to, or are on the verge of concluding, meaningful trade and security agreements with the United States. Goods of those trading partners will remain subject to the additional ad valorem duties… until such time as those agreements are concluded.” said PTC.

This implies that tariffs on countries like Pakistan, Vietnam, and Indonesia could be revised—upward or downward—based on the final agreements. If a clause requires that only US or Pakistani-origin raw materials be used, Chinese raw materials would need to be replaced, impacting SME exporters who rely on China for quality, affordable inputs.

For reference, the US has imposed additional tariffs of 30% on Chinese-manufactured man-made fiber (MMF) apparel and 37.5% on cotton-based apparel. In comparison, Pakistan faces a 19% tariff. However, China’s low production costs allow it to absorb these tariffs, although many major US retailers are looking to shift sourcing out of China due to broader uncertainty.

One side effect is that China—and India—could dump unsold textile goods into markets like the EU and UK, intensifying competition for Pakistan in those regions.

Notably, average US tariffs have now increased to 15.3%. It’s estimated that the US government could earn \$420 billion from these duties. As manufacturers and retailers are unlikely to absorb this cost, it will be passed on to US consumers, potentially fueling inflation. According to industry experts, this could compress textile and apparel demand by 5–10%.

PTC emphasized that for Pakistan to offer concessions to the US, it must sign a formal PTA, as required under WTO rules. During these negotiations, Pakistan should insist on duty-free access for key export products. If properly negotiated, such a PTA could deliver the benefits Pakistan is seeking.

However, the PTC stressed that the government must include seasoned industry experts—alongside official negotiators—to ensure Pakistan secures the most favorable terms. Ends