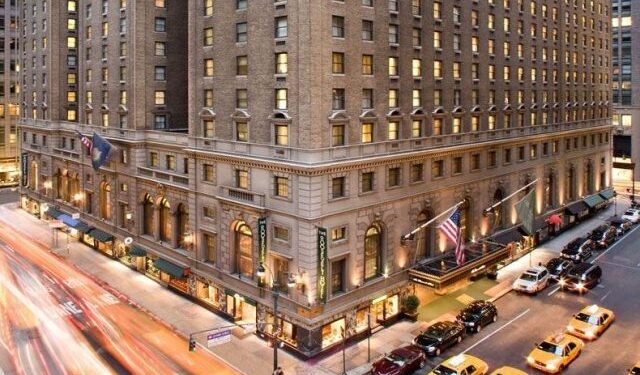

ISLAMABAD : The Cabinet Committee on Privatisation (CCoP) which is scheduled to meet on Monday(today) is likely to approve JV option for Roosevelt Hotel with multiple exit options as the preferred Transaction Structure option and sale of property upon entitlement, Newzshewz has learnt reliably.

According to the detail, CCoP in its meeting held on December 26, 2022 directed Privatisation Commission (PC) to initiate the process of appointment of Financial Advisor (FA) to undertake the envisaged leasing of Roosevelt Hotel Corporation (RHC) site for setting up a Joint Venture Project for prospective mixed-use development through the best suited mode as delineated in PC Ordinance, 2000 Resultantly, FA hiring process was initiated and Financial Advisory Services Agreement (FASA) was signed, after following a competitive and due process, with Jones Lang LaSalle Americas, Inc (JLL), one of the best real estate consultant in the USA, on February 02, 2024.

As part of its deliverables, the FA was required to carry out comprehensive due diligence exercise covering, among other areas, review of 2021-2023 audited financial statements, existing lease with NYC related to housing migrants, leases with retail tenants, tax documents, labor and union contracts, analysis of land area and sub-surface considerations, market studies and comparable related to contemplated structures, review of various risks, zoning (ULURP/additional Air Rights), MTA negotiations, construction related considerations, operational considerations, etc.

The FA was also required to submit a Transaction Structure Report evaluating alternate transaction structure options for the mixed-use development with details of proceeds, risks, investment required, investor profile, regulatory approvals, etc.

The Transaction Structure Report (TSR) of June 28, 2024 was shared with the stakeholders (PIAIL, Aviation Division, Finance Division, Law Division) for their review and comments A meeting of stakeholders was scheduled on July 12, 2024 and comments of stakeholders were received by August 15, 2024 . The TSR was updated accordingly.

The Transaction Structure Report submitted by FA shared different possible transactions structure options for the divestment of RHC Asset.

In its meetings held on August 20 & 29, 2024, PC Board deliberated on TSR and recommended the following for consideration of CCP ” ….Privatisation of Roosevelt Hotel may be considered in G2G mode under the IGCT Act, 2022 and all three transaction structure options i.e. JV, Outright sale and Long-term Lease may be kept on the table for negotiations with potential investor”

Thereafter, the recommendations of PC Board were considered by CCoP in its meeting held on November 14, 2024. CCoP constituted a committee under Minister of State for Finance, Revenue and Power to look into the legal, financial, technical and international aspects of the proposal while also keeping in view the context of emerging politico economic landscape in the USA and submit recommendations in the next meeting of CCOP . Privatisation Division notified the composition and ToRs of the committee on December 19, 2024.

The Committee made following recommendations in its report ;(i) CCoP may instruct PC to continue and conclude the privatisation process through competitive bidding; and (ii) PC to recommend most suitable transaction structure option for privatisation of Roosevelt Hotel keeping in mind potential risks and time to realize full proceeds, to CCoP for its consideration.

The report of the Committee was considered by the CCoP in its meeting held March 11, 2025, and the CCoP directed that: “….recommendations of Privatization Commission on transaction structure options to be adopted for privatisation of Roosevelt Hotel, in order of preference, be presented for consideration of CCoP in its next meeting….”.

In compliance of the CCOP’s decision, PC-Board, on March 17, 2025, held detailed deliberations on the following transaction structure options: (i) sale of land on as is basis; (ii) sale of land post entitlement (deferred milestone-based payment); (iii) sale via medium term Joint Venture. (6-10 years); and ; (iv) 99 year Ground Lease.

On March 26, 2025, PC Board constituted a committee including board members to discuss in detail various transaction structure options analyzed in TSR with FA and present final Transaction Structure options before the PC Board. The Committee held deliberations with the FA on March 26 & 28, 2025 and April 04 & 08, 2025, to discuss each structure with reference to its potential for expected proceeds, value creation, advantages/disadvantages, potential risks and mitigations. During these deliberations the FA recommended the JV structure with multiple exit options post completion of entitlement process to reduce the risk for GoP and provide it more flexibility.

In order to maintain confidentiality w.r.t the expected proceeds, notional values have been adopted in the information. The FA also presented the strategy and measures to minimize the risks associated with the proposed JV option.

The results of the deliberations were presented to PC Board in its meeting held on April 17 & 18, 2025, and after detailed discussion, PC Board approved JV option with multiple exit options to CCoP as the preferred Transaction Structure option and Sale of property upon entitlement as second option….

The CCoP will finalize its recommendation on Roosevelt Hotel transaction which will be presented to the Federal Cabinet for final nod. Ends