Date: September 10, 2025

Authors: Imran Nasir Sheikh, Asim Riaz

Israel’s September 9, 2025 strike in Doha, which targeted senior Hamas figures, marked a rare use of force inside the capital of a U.S.-aligned Gulf state. The episode sharpened debates over operational feasibility, how host-nation sovereignty is treated, and the downstream implications for regional stability and global energy markets.

Qatar’s status as a Major non-NATO ally (MNNA) and host to Al Udeid Air Base anchors the U.S. posture in the Middle East. Al Udeid is the region’s largest American facility and the forward headquarters of U.S. Central Command, supporting roughly 10,000 personnel and enabling strike, intelligence, surveillance, reconnaissance, and command-and-control functions. Any operation in Doha’s airspace therefore carries both military and political consequences.

From an aviation perspective, the reported profile implies deliberate planning. A one-way distance on the order of 1,800 kilometers, multi-state overflight, and a multi-aircraft package would typically require aerial refueling and careful deconfliction. Stealthy ingress reduces exposure, but tankers and other non-stealth enablers still create signatures detectable by regional sensors. The absence of visible intercepts can reflect tacit toleration by one or more states, very tight emission control and timing, or some combination of both.

Non-engagement by Qatari or U.S. air defenses does not necessarily indicate technical failure. Rules of engagement (ROE), positive identification procedures, and fratricide risk can delay or deny firing authority when tracks correlate as friendly or coalition-associated. Time-sensitive strikes also compress decision windows, especially when notifications arrive late or are incomplete.

Targeting a high-value meeting in a capital points to a time-sensitive targeting cycle. Such operations typically pair precise ISR with either standoff munitions released from adjacent airspace or low-observable platforms employing internal, GPS- or INS-guided weapons. Tanker support preserves altitude, energy, and egress options, and would likely be scheduled on at least one leg of the mission.

Open-source claims that tankers held east of Qatar and that routes transited multiple flight-information regions remain unverified. Corroboration would include radar tracks of tanker orbits, air-traffic-control recordings showing pre-cleared corridors, munitions-debris analysis, and satellite imagery of surge activity at divert fields. Until such indicators are public, assessments should treat precise routing and asset mixes as provisional.

Diplomatically, the strike cuts against Qatar’s role as a mediator and raises sovereignty concerns among Gulf partners. Treating Doha as a venue rather than a partner risks fraying basing relationships and encourages regional hedging. It also increases pressure on U.S. coordination discipline at a time when access and quiet deconfliction are strategic enablers.

Doha’s reputation for neutrality in international negotiations rests on a security bubble jointly managed by U.S. forces and the Qatar Emiri Air Force. A breach of this bubble is detrimental to Qatar’s sovereignty and to international confidence in Doha’s capacity to host peace talks among belligerents. It is also important to note that such strike packages are not planned overnight or executed in haste. Perceptions in some quarters that Israel acted with U.S. acquiescence—whether accurate or not—risk further eroding confidence, normalizing cross-border strikes in allied capitals, and emboldening other actors to test red lines. The reactions of major powers, including China, will shape whether this episode becomes precedent.

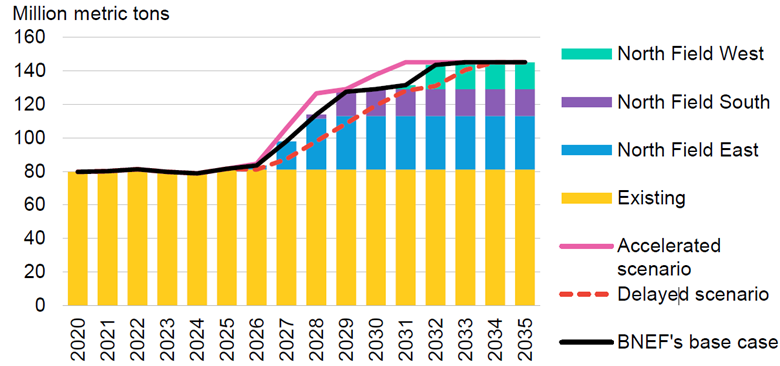

The energy backdrop is where strategic incentives converge. Qatar’s LNG liquefaction capacity stands near 77 MTPA today. Through the North Field East expansion, total nameplate capacity is planned to reach 110 MTPA by 2026, with initial incremental production in mid-2026. Subsequent phases at North Field South and North Field West are slated to lift capacity to 126 MTPA by 2027 and ~142 MTPA by 2030. A meaningful share of these volumes is not yet locked into long-term contracts, enhancing Doha’s portfolio flexibility as new supply comes online.

Figure 1: Qatar LNG supply outlook and scenarios – Source: BloombergNEF

Qatar’s next phase is about portfolio management, not just construction. Entering 2026–2030 with an unusually large block of uncontracted LNG, Doha faces a simple strategic choice: accelerate start-ups to capture market share and push prices lower, or pace deliveries to support higher price levels. Historically it has preferred long-term, oil-indexed contracts with destination clauses, which strengthens its bargaining position.

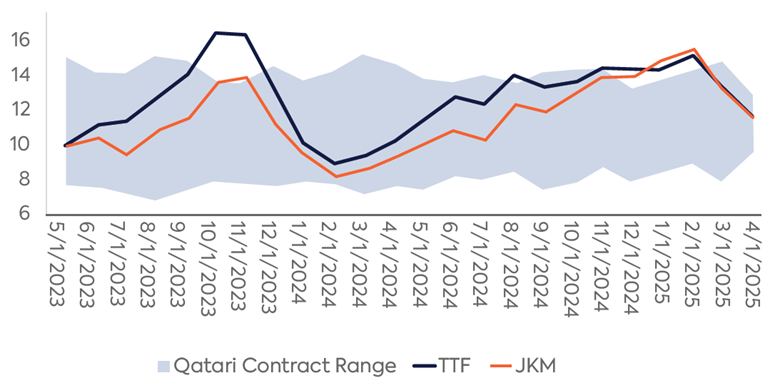

Figure 2: Qatari LNG contract price ranges versus JKM and TTF (S&P Global)

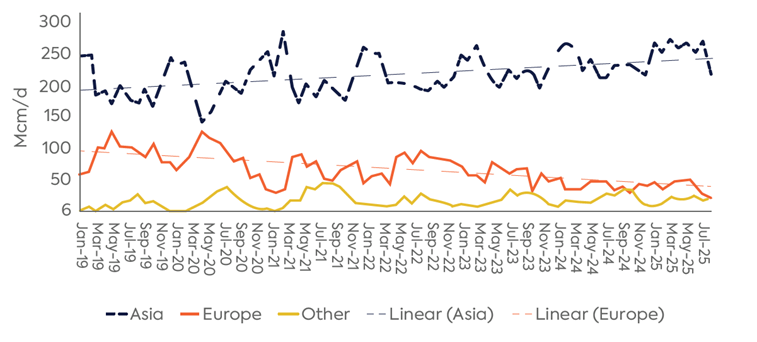

Figure 3: Qatari LNG exports by region

How Qatar adjusts those levers—tenor, indexation, diversion rights, and the role of aggregators—will set price expectations, influence competitors’ FIDs, and shape LNG demand growth through the decade. With significant uncontracted tranches arriving, Doha can accelerate commissioning where feasible, lean into DES or FOB spot placements, and use portfolio agility to push near-term prices lower. That dynamic can undercut Henry-Hub-linked U.S. projects on netbacks, chill marginal pre-FID activity, reroute trade flows, and entrench Qatar as a cost-anchor supplier in a loosening market.

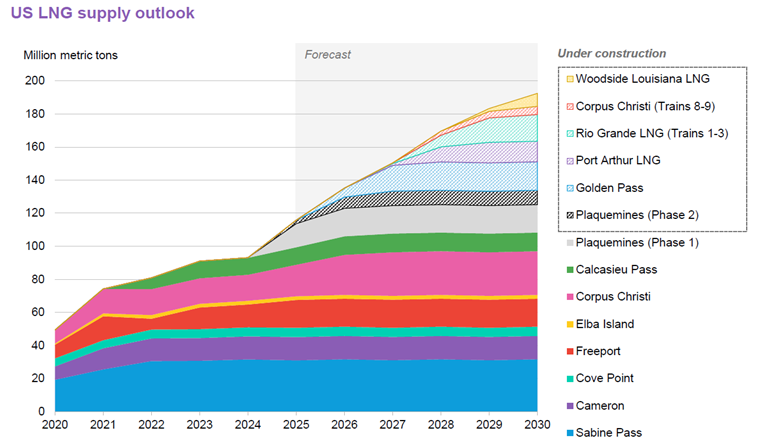

Figure 4: US LNG supply outlook – Source: BloombergNEF

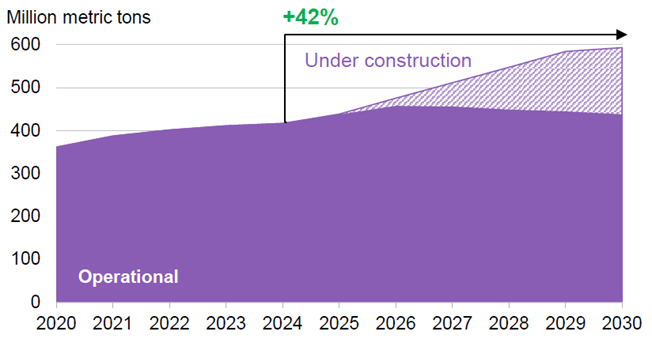

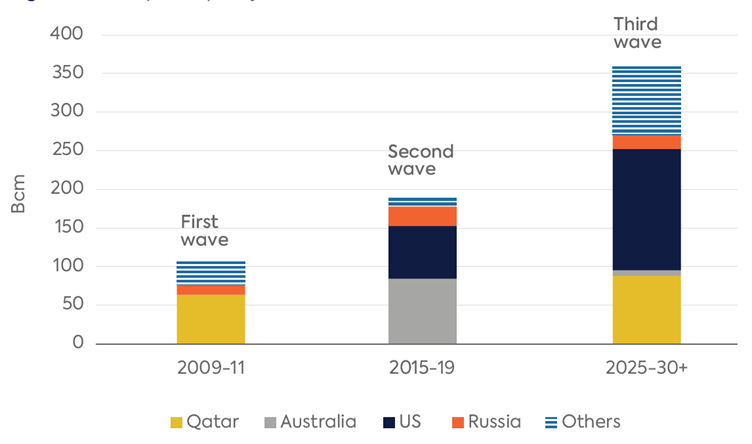

A surge in uncontracted supply is poised to outstrip demand and exert downward pressure on global LNG prices: roughly 180 MTPA of new liquefaction is due online by 2028, with another ~70 MTPA becoming contestable as long-term SPAs (sale and purchase agreements) expire, about 250 MTPA seeking new buyers. Over the same horizon, global LNG trade is projected to rise from ~410 MTPA (2024) to 480–510 MTPA by 2030, while liquefaction capacity expands from ~495 MTPA (end-2024) to ~620–720 MTPA by 2030, led by the United States and Qatar.

Figure 5: Global LNG supply outlook to 2030 – Source: BloombergNEF

In this structurally looser market, an international-relations reading posits issue-linkage by Washington: tolerating elevated security friction around Doha to blunt Qatar’s rising market power and to embed a geopolitical risk premium in LNG benchmarks (JKM, TTF), thereby supporting U.S. Gulf Coast netbacks, sustaining FIDs on Henry Hub-linked trains, and slowing placement of Qatar’s low-cost, uncontracted additions. Such signaling might preserve bargaining leverage on basing and mediation, but it also creates sovereignty externalities, eroding host-nation consent, raising audience-cost risks for allies, and undermining long-term coalition access.

A competing interpretation is that tolerance for elevated geopolitical risk around Doha is intended—or at least accepted—to add a risk premium to LNG benchmarks. Higher Asian and European prices improve U.S. Gulf Coast netbacks and support projects that might otherwise stall before FID; they would also benefit Russia, which relies heavily on oil and gas rent capture, including pipeline gas and sanctioned LNG volumes that still move via intermediated trade. If that is the game, permissive signaling that erodes Qatari sovereignty, slower crisis coordination, and ambiguous red lines raise buyer anxiety, push procurement toward longer-tenor contracts with non-Qatari sellers, and constrain Doha’s ability to place large uncontracted volumes quickly. Any apparent price benefit arrives with strategic costs to basing access, coalition cohesion, and European energy security.

Figure 6: LNG export capacity increases across waves – Source: Columbia University (CGEP)

Against this backdrop, tolerating sustained pressure on Qatar may look commercially savvy but risks winning the battle while losing the war. The steadier course is to reinforce host-nation consent, tighten airspace deconfliction procedures that affect Doha, and de-link security guarantees from commercial energy competition. Compete with Qatar on price, reliability, and contractual terms, not by normalizing sovereignty exceptions that undermine the access and trust on which U.S. operations depend. In practical terms, that means stating explicit limits and the mechanisms for enforcing them, rather than relying on elastic red lines.

Authors:

Imran Nasir Sheikh

Imran Nasir Sheikh is a seasoned naval aviator with extensive operational experience in maritime surveillance and anti-submarine warfare. He is currently pursuing a PhD in Defence and Strategic Studies at Quaid-i-Azam University, Islamabad, where his research focuses on the nuclear threat dynamics in the Indian Ocean Region, particularly in relation to the evolving strategic landscape and the maritime security of China-Pakistan Economic Corridor (CPEC). His work explores the intersection of undersea deterrence, regional power projection, and sea-based stability mechanisms in a contested littoral environment.

Asim Riaz

Asim Riaz holds an M.Phil in Strategic Studies from the National Defence University, Islamabad, with degrees in Energy Management and Mechanical Engineering. With a distinguished career spanning over 20 years, he brings expertise in the energy sector, geopolitics, and addressing non-traditional security threats. He is currently serving as Energy Advisor at APTMA, Islamabad.

Email: asimaptma@gmail.com